SDCAA Successfully Hosts Online Seminar on "Legal Tax Strategies in the U.S." SDCAA成功举办《美国合理避税技巧》线上讲座,助力社区财税规划

On June 13, 2025, from 8:00 PM to 9:30 PM, the San Diego Chinese Attorneys Association (SDCAA) hosted an online community seminar titled "Legal Tax Strategies in the U.S." The event featured tax attorney Mr. Yuangong Li as the keynote speaker and was moderated by SDCAA President Zhiming Wang, drawing many participants from diverse backgrounds.

2025年6月13日晚8点至9点30分,圣地亚哥华人律师协会(SDCAA)举办了一场主题为《美国合理避税技巧》的线上社区讲座。本次活动由知名税务律师李元功主讲,SDCAA会长王志明担任主持,吸引了许多来自不同背景的听众参与。

Mr. Li presented actionable tax-saving strategies tailored to three key demographics:

讲座中,李元功律师针对三类常见税民群体,系统性地分享了合法避税的实用策略:

1. Middle-Class Employees: Maximizing tax benefits via retirement accounts (e.g., 401(k), IRA), education credits, and medical expense deductions.

1. 中产阶级员工:如何最大化利用401(k)、IRA等退休账户抵税,以及教育开支和医疗费用的税务抵扣技巧。

2. Small Business Owners: Optimizing entity structures (e.g., S Corp/LLC), deductible business expenses, and family employment arrangements.

2. 小企业家:通过公司结构优化(如S Corp或LLC)、业务支出分摊及家庭雇佣等途径降低税负。

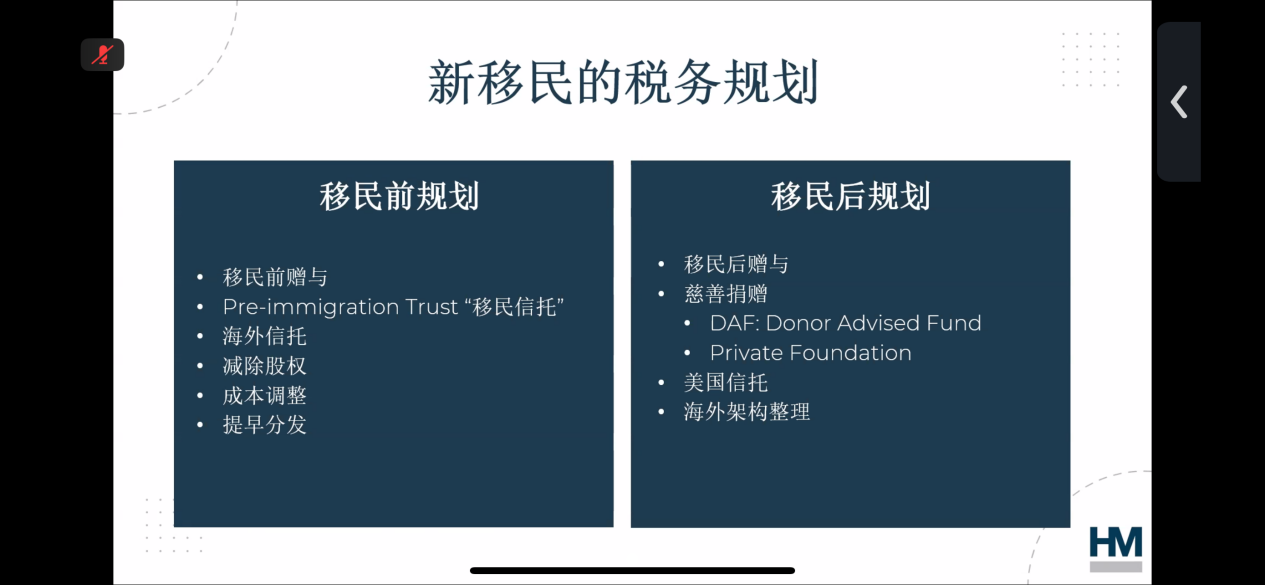

3. New Immigrants:

3. 新移民:

l Donor Advised Funds (DAF): Establishing a DAF allows new immigrants to claim immediate tax deductions while retaining advisory control over charitable distributions.

捐赠者建议基金(DAF, Donor Advised Fund):通过设立DAF,新移民可以在捐赠当年享受税务减免,同时保留对资金分配的建议权,灵活支持慈善事业。

l Pre-immigration Trusts: Setting up trusts before becoming U.S. tax residents can shield offshore assets and minimize future tax liabilities.

移民前信托(Pre-immigration Trust):在成为美国税务居民前设立信托,有效保护海外资产,减少未来的税务负担。

Additional strategies included cross-border tax planning, FBAR compliance, and leveraging tax treaties to avoid double taxation.

其他策略包括跨境税务规划、外国账户披露(FBAR)义务,以及避免双重征税的条约应用。

During the Q&A session, participants actively sought personalized advice on how to legally reduce taxes in their specific circumstances. Mr. Li provided thoughtful responses to each inquiry, skillfully referencing real-world examples from the presentation to illustrate practical applications of the tax strategies discussed.

在问答环节,参会者纷纷结合自身实际情况提出问题,咨询具体情况下如何实现合法减税。李律师耐心细致地一一解答,并巧妙结合讲座中提到的实际案例进行深入分析,使抽象的理论知识变得生动具体,便于听众理解和应用。

SDCAA President Zhiming Wang noted, "Our mission is to equip the Chinese community with legal tools for informed financial decisions, especially for new immigrants navigating complex tax landscapes."

SDCAA会长王志明表示:"协会将持续举办此类公益讲座,帮助华人社区在遵守法律的前提下,优化财务决策。特别是针对新移民,我们希望通过专业的税务规划,帮助他们顺利过渡并最大化财务利益。"